2025 Q3 Market Outlook

It is hard to believe we are already in the thick of summer and it is even harder to believe this marks our third Market Outlook of 2025. Time flies when markets are volatile, legislation is moving, and the economy keeps everyone guessing. As we soak up the sun here in the Pacific Northwest (finally), it feels like the perfect moment to take a breath and check in. In this quarter’s market outlook, we are recapping where things stand now that we are halfway through the year, what has surprised us so far, and what we are watching closely as we head into the second half of 2025. From market momentum to economic shifts and new tax considerations, there is a lot to cover!

Looking back on the first half of 2025

As we look back on the first half of 2025, much of what we anticipated has played out. We came into the year expecting a solid, though not spectacular, market performance overall, with the potential for high single-digit returns from start to finish. At the same time, we were clear-eyed about the likelihood of significant volatility along the way. That theme of staying nimble and preparing to adjust has proven to be spot on. The year kicked off with elevated valuations, particularly in some of the high-flying tech names, and a changing political administration added another layer of uncertainty. True to form, the market has delivered a mixed bag so far; stretches of strong performance interrupted by sharp pullbacks, driven by shifting economic data, policy speculation, and investor sentiment.

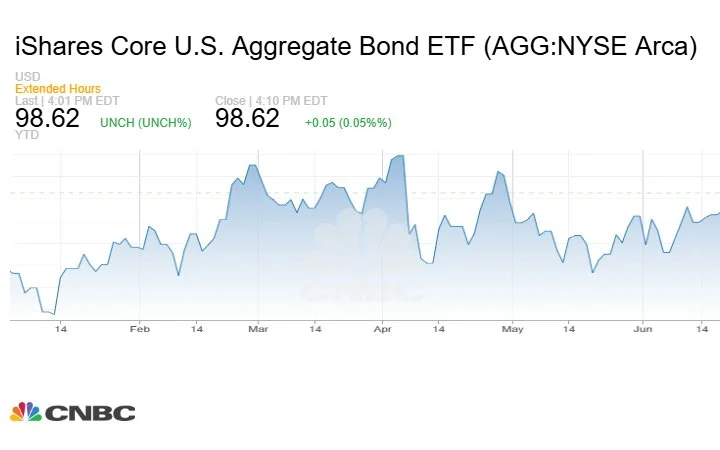

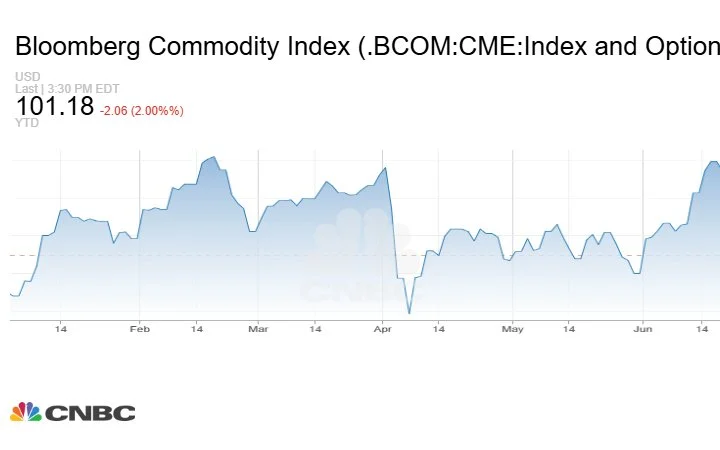

As of mid-July 2025, asset class performance has painted a relatively balanced, though somewhat surprising, picture. The S&P 500 has delivered a solid 7.18% return year to date, reflecting strength in large-cap equities despite ongoing volatility. Bonds have quietly held their own as well, posting gains just over 3%, offering some welcome stability. Cash and money market funds remain attractive, with most still paying a bit over 4%, though yields have edged slightly lower. Commodities have also turned in a strong showing, up around 7.5% year to date, fueled in part by global supply dynamics and inflation trends. Additionally, for the first time in quite a while, international equities have stepped up, becoming a meaningful contributor in the broader markets.

Are you prepared for taxes in retirement?

For more long-term tax planning strategies, claim your FREE copy of Brandon’s eBook, Retire by Design!

Most of this international growth is due to some stimulus that has been injected from a challenged economy. Also, because of all the uncertainty here in the U.S., I think we saw a lot of money moving over to international markets, highlighting the importance of diversification. However, historically, the U.S. has outperformed significantly, so it is important to avoid trying to time this momentum and increase exposures just to chase returns.

The S&P 500 returns in 2025

So far roughly halfway into 2025, S&P 500 returns have been solid, but what has been more interesting is what is driving them. As of mid-July, the index is up just over 7% year to date, but when you dig beneath the surface, the story gets more nuanced. While technology and communication services have staged a comeback, it is actually the value-oriented sectors, particularly industrials, that are leading the charge. Industrial stocks, often overlooked in favor of headline-grabbing tech giants, are currently the top-performing sector within the S&P 500. Other value-heavy sectors like utilities, consumer staples, and financials have also posted strong results, helping to broaden out market leadership beyond just a handful of high-flying growth names.

What makes this shift even more compelling is not just the return numbers, but the way these sectors have performed from a risk-adjusted perspective. Value-oriented sectors like industrials have not just generated strong gains, they have also provided greater stability through the year’s bouts of volatility. While some areas like IT saw sharper drawdowns during market dips, industrials barely dipped into negative territory during those same periods. This kind of resilience highlights why portfolio shifts to broaden out your holdings have not just been about chasing performance, but also about managing risk more effectively. In a year that has already delivered its fair share of ups and downs, that kind of balance between return and risk has been especially valuable.

Looking ahead in 2025

As we look ahead, we feel the same that we do about where markets are headed at the halfway point as we did at the very start of the year. We believe markets will end near where we are today, or possibly slightly higher, but we do not believe that the volatility is behind us quite yet. We may see some more of that volatility peek its head up in the short-term horizon. The reasons we believe we may see volatility in the short term include tariffs, earnings expectations, and upcoming decisions from the Federal Reserve.

Recently, tariff deadlines were pushed back to August 1st with news about new tariffs that are being introduced. Regardless of where tariffs fall, with uncertainty around the tariff landscape, we may see volatility pick up from time to time.

Additionally, earning expectations will play a role in market volatility. As we find ourselves in the middle of July, we are right at the start of the earnings season. Analysts are anticipating modest earnings per share growth. There is some possibility that we could be surprised on the upside again, especially from companies with stronger balance sheets and more stability.

The third consideration is what decisions the Federal Reserve makes ahead. If the Fed does end up cutting rates and if inflation does not pick up to the extent they are concerned about, then this is absolutely something to watch. If it happens that the Fed cuts rates, coupled with a strong earnings season, we could see a market rally. However, this would require a perfect storm. The reality is that there is a lot of uncertainty on the shorter-term horizon.

Wrapping it up

As we wrap up the first half of 2025, our approach has remained consistent with the theme we set at the start of the year: stay nimble.

Looking ahead, a strong allocation with balanced risk gives us flexibility. Should volatility return, cash reserves provide valuable dry powder to take advantage of potential market pullbacks. Overall, while we continue to expect a strong point-to-point year in 2025, much of that strength has already shown up in the first half. That is why our focus going forward remains on thoughtful asset allocation, active rebalancing, and maintaining a balanced risk-reward profile as we head into the second half of the year.