What the One Big Beautiful Bill Means for Your Taxes in Retirement

As the landscape of tax policy continues to evolve, the newly passed One Big Beautiful Bill Act (OBBBA) is poised to have a significant impact on pre-retirees and retirees. This legislation brings meaningful changes to key areas of tax planning, and understanding its implications is essential for making informed decisions about your financial future. In this article, we will take a closer look at what the new bill includes, how it compares to past legislation like the Tax Cuts and Jobs Act of 2017, and what it could mean for your tax strategy in 2025 and beyond. While we will touch on broader areas like retirement income planning and estate planning, our focus here is on helping you make sense of the latest updates and how they might affect you moving forward.

How the One Big Beautiful Bill Act (OBBBA) Compares to the Tax Cuts and Jobs Act (TCJA) of 2017

The One Big Beautiful Bill Act (OBBBA) builds on many of the provisions first introduced in the Tax Cuts and Jobs Act (TCJA) of 2017, while also making several key adjustments. Under the TCJA, the standard deduction was essentially doubled, which led many taxpayers to take the standard deduction rather than itemizing, as it became harder to exceed the new threshold. The TCJA also lowered income tax brackets across the board, including a significant reduction to the top marginal rate.

However, these changes were temporary and set to sunset at the end of 2025 unless new legislation was passed. That is where OBBBA comes in. Rather than letting those provisions expire, the new bill makes many of them permanent, including the lower tax brackets and the elevated standard deduction.

Updated Tax Brackets, the Standard Deduction, and Other Deductions Under the OBBBA

One of the key outcomes of the One Big Beautiful Bill Act is the permanent extension of the income tax brackets first introduced under the Tax Cuts and Jobs Act of 2017. While “permanent” in legislative terms doesn’t mean unchangeable, it does mean the lower, more favorable brackets many have become accustomed to will continue beyond their original sunset at the end of 2025.

The OBBBA preserves the progressive tax system, meaning different portions of your income are taxed at different rates. For example, in 2025, a joint filer with $100,000 in taxable income would have their first $23,850 taxed at 10%, the next portion up to $96,950 taxed at 12%, and only the amount above that taxed at 22%. While annual adjustments for inflation still occur, the fundamental structure and thresholds of the current tax brackets remain intact, providing consistency and predictability for income tax planning in the years ahead.

The OBBBA also slightly increases the standard deduction again, raising it from $15,000 to $15,750 for single filers and from $30,000 to $31,500 for joint filers in 2025.

When it comes to deductions, two important changes have now been made permanent under the new law. First, the child tax credit, which was previously set to expire, has been made permanent and will increase to $2,000 per child in 2026. This credit is also indexed for inflation, meaning it is expected to rise gradually each year. Finally, the $750,000 cap on the home mortgage interest deduction, which limits the amount of mortgage debt eligible for interest deductions, has also been made permanent.

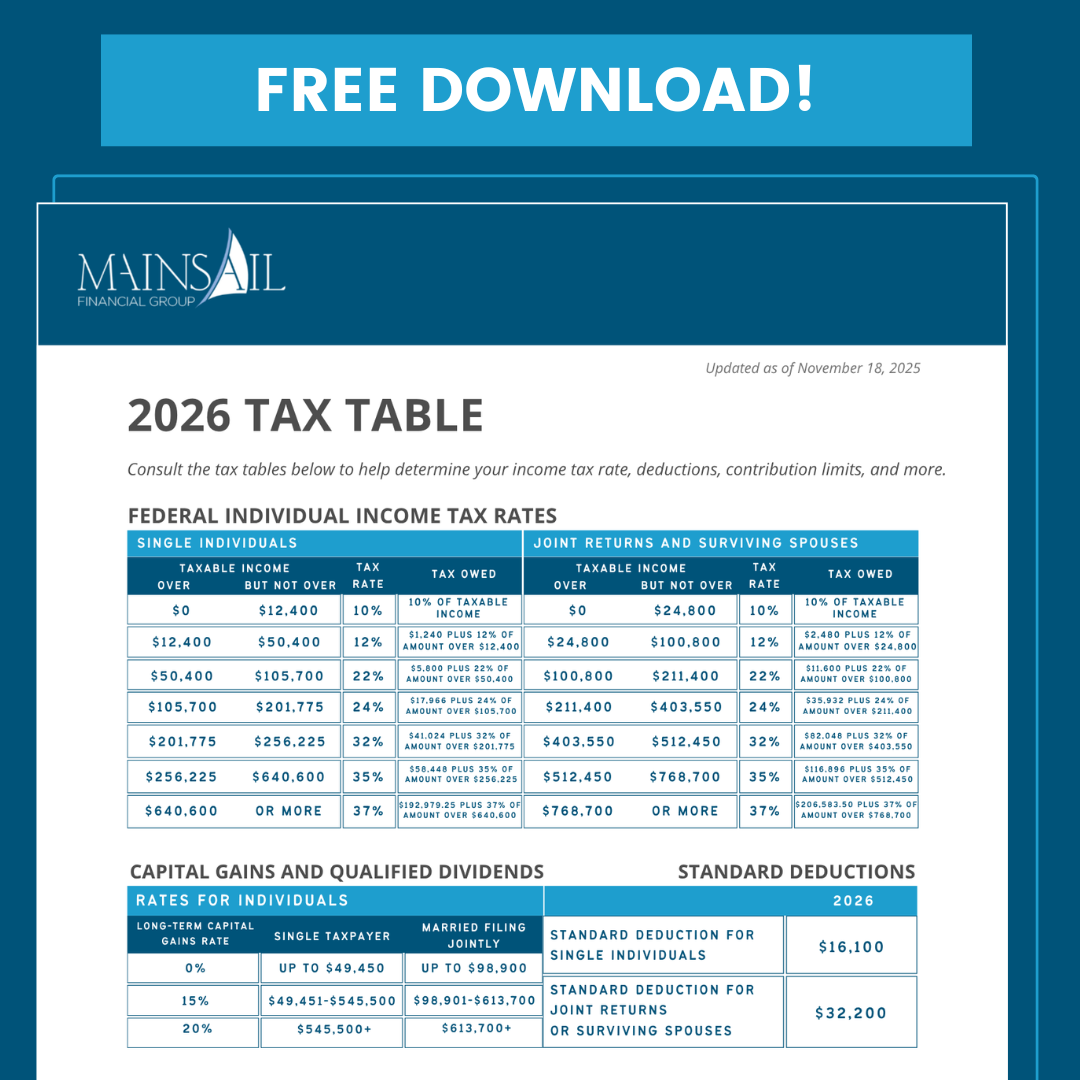

Download your complimentary 2025-2026 Tax Table

State and Local Tax (SALT) Deduction Cap Increase

Another notable update in the One Big Beautiful Bill Act involves changes to the state and local tax (SALT) deduction cap, or the deduction that individuals and couples could take for the property taxes that they pay if they have a state income tax or pay sales tax. This deduction can significantly affect taxpayers who live in areas with higher property or income taxes, such as in states like New York, California, and even here in the state of Washington to some degree.

Under previous law, the SALT deduction was capped at $10,000, meaning that even if you paid well above that in combined state and local taxes, only $10,000 could be deducted when itemizing. This cap led many individuals, especially those with higher property taxes or multiple residences, to default to taking the standard deduction. However, with the OBBBA raising the SALT cap from $10,000 to $40,000, itemizing deductions may once again become more appealing for some taxpayers.

It is also worth noting that for individuals with adjusted gross income (AGI) over $250,000, or $500,000 for joint filers, the expanded SALT deduction is reduced by 30%. This provision is primarily targeted at higher-income households and may not affect the majority of taxpayers. Interestingly, the expanded deduction is scheduled to expire in 2029, with the cap reverting back to $10,000 in 2030. Additionally, the total amount of itemized deductions allowed is now limited to 35% of your income, so high earners should be aware of this cap.

Modifications to Overtime and Tip Income under the OBBBA

The One Big Beautiful Bill Act introduces several new temporary deductions aimed at providing tax relief to working individuals, particularly those in hourly or service-based roles. One provision allows workers who earn tips to deduct up to $25,000 of those earnings if their income is below $150,000 (or $300,000 for joint filers). While the IRS will release a finalized list of qualifying occupations by October 2, 2025, this deduction is intended to recognize income earned outside of base wages.

Similarly, the Act includes a deduction for qualified overtime compensation. Workers can deduct the "extra" portion of overtime pay, such as the ‘half’ potion of "time-and-a-half" pay structures, up to $12,500 per individual, or $25,000 for joint filers if both spouses qualify. Employers will be responsible for identifying and reporting eligible overtime compensation, though the exact mechanism (e.g., a W-2 box or a separate tax form) has yet to be determined. Both the tip and overtime deductions are set to expire after 2028, so while they are meaningful in the short term, they are not permanent fixtures of the tax code.

New Auto Loan and Sunsetting Clean Energy Tax Deductions

Under the One Big Beautiful Bill Act, individuals may deduct up to $10,000 annually in interest paid on a personal auto loan, provided certain conditions are met. To qualify, the vehicle must be purchased (not leased) for personal use, with the loan originating after December 31 of the prior year, and the original use of the vehicle must begin with the taxpayer. Eligible vehicles include cars, SUVs, vans, trucks, or motorcycles weighing under 14,000 pounds that have undergone final assembly in the United States. The deduction phases out for taxpayers with adjusted gross income over $100,000 (individuals) or $200,000 (joint filers).

The definition of “final assembly” remains unclear and is expected to generate debate, as the IRS has yet to determine whether it requires full or partial domestic assembly. Similar to the overtime deduction provision, lenders will be responsible for reporting the amount of deductible interest paid during the tax year. Details on the exact reporting process, whether via a new tax form or an update to existing documentation, are still forthcoming.

Several clean energy tax credits are beginning to phase out under the One Big Beautiful Bill Act. Most notably, the Clean Vehicle (EV) Tax Credit will end in September 2025, reducing the financial incentive for purchasing electric vehicles. Similarly, the Residential Clean Energy Tax Credit, which currently allows homeowners to deduct up to 30% of the cost of solar panel systems and other qualifying installations, will be eliminated after December 2025.

Also expiring at the end of 2025 are the Energy Efficient Home Improvement Credits, which offer smaller incentives for certain upgrades like Energy Star–rated appliances and qualified heat pumps. If you are planning any energy-efficient home improvements or clean energy purchases, it may be wise to act before these credits expire.

“Tax-Free” Social Security and the Senior Deduction

You may have also heard rumblings on the news or via social media about a supposed tax-free Social Security. I want to set the record straight that that is not the case.

However, what has been introduced under the OBBBA is a new “senior deduction” of up to $6,000 for individuals age 65 and older. This is a deduction in addition to the standard deduction. This senior deduction is income-based, meaning some may phase out of eligibility depending on their overall taxable income, which is modified adjusted gross income over $75,000 for individuals ($150,000 for joint filers). These changes highlight the importance of proactive tax planning, especially for those on the cusp of qualifying for income-based benefits, and as you can see, qualifying for this has nothing to do with Social Security.

It is also very important to mention this — the way Social Security is taxed is unchanged going forward. Depending on your total income, a percentage of the benefit is taxed like ordinary income, and like many of the other bill modifications, is set to sunset at the end of 2028.

Are you prepared for taxes in retirement?

For more long-term tax planning strategies, claim your FREE copy of Brandon’s book, Retire by Design!

Charitable Gifts Under the One Big Beautiful Bill Act (OBBBA)

The One Big Beautiful Bill Act also addresses a common issue many taxpayers have faced in recent years: the limited tax benefit for charitable giving due to the higher standard deduction. Because fewer people were itemizing, many charitable gifts didn’t translate into meaningful tax savings. To help offset this, the OBBBA introduces a new provision allowing joint filers to claim a separate deduction of up to $2,000 for cash gifts to qualified charities, even if they take the standard deduction. However, it is important to note that this deduction does not apply to donations made to donor-advised funds or private foundations, a key distinction for those who give through more complex philanthropic vehicles. For individuals who give directly to charities in cash, though, this change may offer a modest but valuable tax benefit.

Changes to Lifetime Estate Gifting and Exemptions Under the OBBBA

The federal estate and gift tax exemption has seen a modest but meaningful increase under the One Big Beautiful Bill Act (OBBBA). Under the new legislation, the lifetime exemption has risen from $13.99 million to $15 million per individual, or $30 million for married couples, due to portability between spouses. This means that estates valued below these thresholds can be transferred without incurring federal estate tax. For high-net-worth individuals nearing or exceeding this limit, this increase may provide a valuable planning window to explore strategies such as lifetime gifting, trusts, or other estate reduction tools. It also provides relief to those who were uncertain about whether to act before the previously scheduled sunset of the Tax Cuts and Jobs Act, which would have significantly reduced the exemption starting in 2026.

It is important to note that this exemption applies only to federal estate and gift taxes and does not affect state-level estate or inheritance taxes, which may apply depending on your state of residence. While the increased threshold offers greater flexibility, it does not eliminate the need for proactive estate planning, especially for individuals with estates approaching the new limit. For those with assets above the exemption, careful planning remains essential to reduce potential estate tax liability and ensure assets are passed on according to your wishes.

529s and Education Funding Under the OBBBA

The One Big Beautiful Bill Act introduces several notable updates to education funding, starting with expanded use of 529 plan assets. Traditionally, 529 plans have been used primarily to cover qualified college expenses. However, under the new law, the definition of “qualified education expenses” has broadened to include elementary, secondary, religious, and private school tuition. This change offers families more flexibility to use existing 529 funds for a wider range of educational needs, particularly helpful for those with children in private or religious K–12 institutions, up to $20,000.

In addition to updates to 529 plans, the OBBBA also introduces a new type of savings vehicle called a “Trump Account,” which will be available starting in 2026. Designed for minors, these accounts allow for annual contributions of up to $5,000, growing tax-deferred like a traditional IRA. While contributions are not tax-deductible, the account grows tax-free, and once the beneficiary turns 18, they can access it similarly to a retirement account. As an added incentive, the federal government will contribute a one-time $1,000 seed deposit for children born between December 1, 2025, and December 31, 2027. While still new and somewhat untested, Trump Accounts offer an additional option for families looking to bolster long-term savings, particularly for retirement, on behalf of children or grandchildren.

With this major legislation update, we know it can bring about many questions about your specific situation. Please do not hesitate to reach out to our team below — we would be happy provide further guidance!

Advisory services offered through Mainsail Financial Group, LLC, a Registered Investment Adviser. For informational purposes only, not intended as tax advice. Please consult a tax professional when appropriate.